Like this post? See the main page for the rest of the Financial Freedom series!

OneMain Financial is a lender whose primary product is issuing personal loans to nonprime borrowers. They serve customers with lower credit scores (who cannot get loans from traditional lenders like banks) and charge high interest rates on these loans, ranging from about 24% to 29%.

History

Origins (1912 - 2015)

The two ancestors of OneMain are the Commercial Credit Company and Interstate Finance Corporation, founded in 1912 and 1920 respectively. The former was eventually acquired by Citigroup, while the latter became a part of American International Group (AIG). In the aftermath of the 2008 Financial Crisis, both operations were sold off by their larger owners as they restructured themselves. Citigroup’s spinoff (CitiFinancial) was acquired by AIG’s spinoff (Springleaf) in 2015, with OneMain becoming the preeminent brand. Through both companies, OneMain’s roots in lending go back more than a century, surviving many recessions and financial crises.

Reformation (2015 - 2019)

In the years that followed 2008, OneMain needed to recapitalize itself. Starting in 2014, it inititiated a public offering to spin off from Citigroup. After Springleaf acquired it in 2015, a public offering of almost 19 million shares was made to the public, in order to raise capital for a company that was reinventing itself.

OneMain began improving their originations process, in order to increase the quality of its loanbook and reduce losses from defaults. Crucially, it reduced the size of unsecured loans from its highs in 2008.

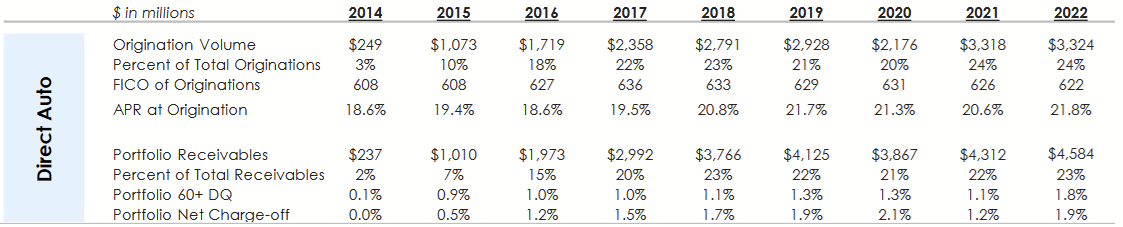

Much of that void was also filled with its Direct Auto line, which it started in 2014 and has enjoyed a much lower rate of default.

With these practices, OneMain began steadily growing its tangible assets with successful loans and without the need to sell more shares. Its intangible assets began a trend of shrinking instead of rising. With just over 1,200 branch locations in 2014, they had grown that number to over 1,500 by the end of 2019.

By 2019, profitability had improved that OneMain began paying dividends to its share holders, with four quarterly distributions of $0.25 and a special dividend of $2.50, for a total of $3.50 that year.

COVID, Its Aftermath, and Inflation (2020 - Present)

The first test of their reforms in the prior years came with the arrival of the COVID-19 pandemic in the United States in March 2020. The company remained profitable and continued to pay its dividend. The strength of its balance sheet impressed the capital markets, allowing OneMain to raise almost $2 billion through low-interest bonds in Q420.

OneMain modified its capital allocation strategy. It ceased its policy of special dividends and began repurchasing shares of OMF on the market, while increasing its quarterly dividend to $0.33 in 2020 and eventually up to $1.00 in 2023. Modest share repurchases began in in 2021, while shares were at their all-time high at the peak of the post-COVID market rally.

After the invasion of Ukraine and the impact this had on energy and grain prices, along with the Fed’s decision to hike rights, OMF’s price began to decline, amid fears of a recession. With a lower share price and a shift to tighter originations, OMF began stepping its pace of repurchases. As the share price began to recover more in 2023, the buybacks also slowed down.

As the pandemic required more social distancing, OneMain began to reduce its number of branches to around 1,400 by October 2023. It adjusted a greater portion of its loan originations to its website. In 2021 also began the launch of its BrightWay credit card, hoping to penetrate this market as well, with initial trials appearing promising.

In spite of the disruptions during this period, OneMain’s loanbook remained strong, with low rates of default and profits well in excess of its dividend. Capital markets continued to reward this with more access to capital. In spite of the increased market rates, they managed to refinance some of their existing debt with lower interest and acquire more capital for originations with the largest bond issues in their history.

Current Strategy

OneMain’s “secret sauce” is its proprietary data on customers’ financial well-being. This allows it to produce models that allow originations for lowest-risk customers of a risky credit category as nonprime.

Capital Allocation

In its financial statements and press releases, OneMain includes what it believes are the true owner’s earnings of the business, often described as “capital generation.” In 2020, 2021, and 2022, it generated $1.1, $1.3, and $1 (billion) in capital, respectively. With the capital it generates, OneMain either:

Originates new loans

Reinvests in the company’s infrastructure

Repurchases shares

Pays (or raises) the dividend

Maintains some of it for a sufficient cash balance (as of Q323 it holds about $1.2 billion in cash)

Their capital allocation strategy is young, but so far they have shown a prefence for maintaining sufficient cash reserves when faced with uncertain macro-environments. Similarly, buybacks occur at greater volume when share prices are lower, suggesting OneMain has an intrinsic value for its shares and likes to repurchase at a discount to that value. In its recent earnings calls, management has suggested that high Return on Equity is the primary consideration when originating loans, not growth, meaning that growth will only occur with customers whom they believe are properly vetted and sufficiently capable of repaying their loans.

OneMain is shifting to an increasingly digital presence, with its branches leaning toward services that are more physical in nature and steadily being trimmed after their growth in the 2010s.

Risks

While OneMain decreased its concentration on unsecured loans from the 2008 era, these still make up the largest portion of the loanbook, at approximately 50%.

Because they are not secured by collateral, the potential for higher losses exists. Similarly, since customers do not have collateral to lose, there is greater incentive to go delinquent in times of hardship. While management says that their loanbook is stress-tested for a recessionary environment and should still enjoy a Return on Equity no less than 20% in such a context (it has remained above 22% as of 2023), greater than expected distress in the macro-environment could cause serious harm to their balance sheet.

Balancing for Risk

With its strong, liquid position, OneMain may find itself the personal lender of choice in the event of recession. While they may experience more delinquencies on existing loans, a recession would shift certain lenders who are prime down into the nonprime category. As “normally prime” customers, they would likely have the income and budgetary habits to repay their loans. Competitors with weaker balance sheets will be in less of a position to maintain originations, even with a fresh segment of customers like this.

OneMain, nevertheless, has contingency plans in place. Employees are trained and prepared to pivot from originations roles to collections roles, in order to minimize default and get customers back on repayment plans.

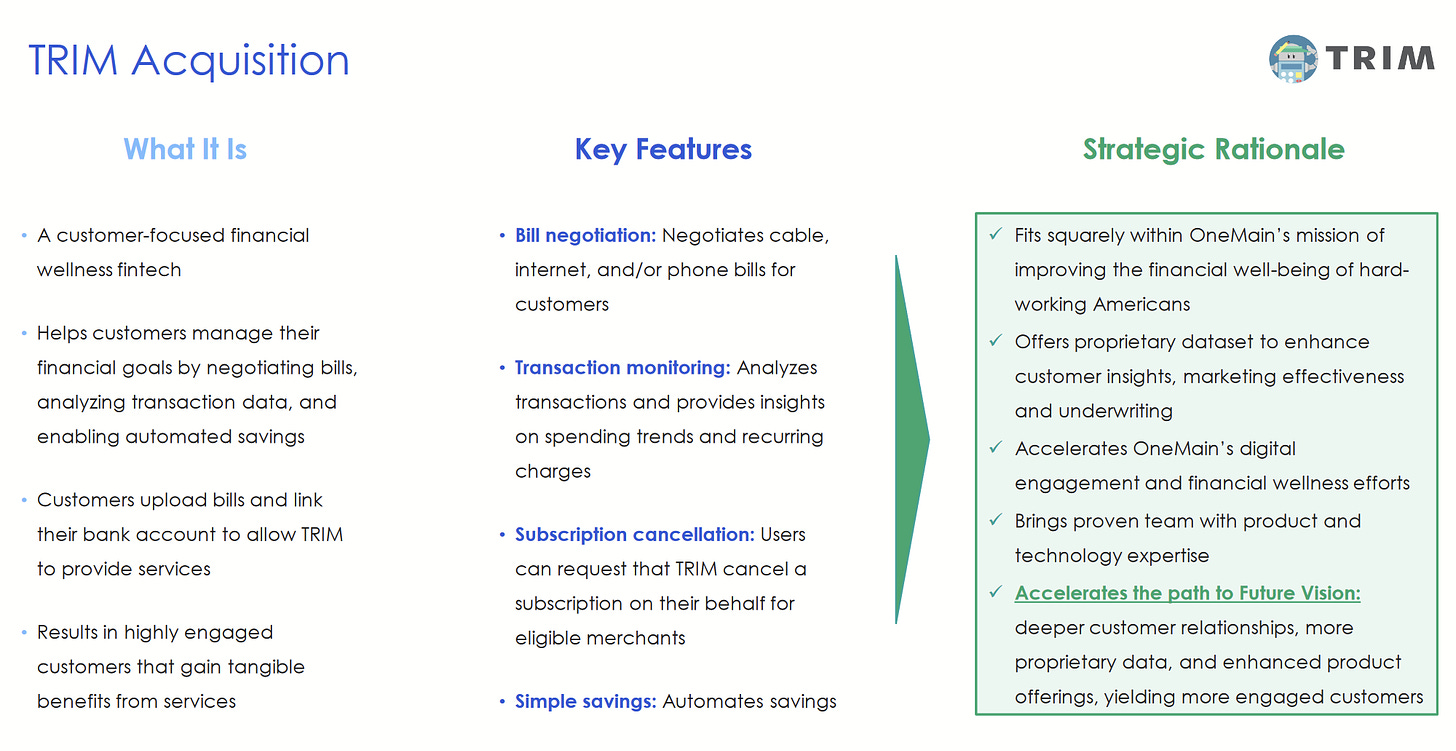

Additionally, OneMain uses a feature called Trim (acquired 2022) as a free feature for customers, to improve their financial planning, budgeting, and cash flow situation. This not only makes it practically easier for customers to repay loans but also increases their satisfaction with OneMain’s service and allows for long-term relationships.

Key Ownership

Insiders

SimplyWall.St gives a breakdown of insider ownership:

Doug Shulman is also the CEO. As can be seen here, he has about $10m of market value in OMF right now, which means he earns about $1m per year alone just in IMF’s dividends.

Funds

A variety of funds and firms own OMF and account for most of its ownership. Many of these positions (such as Vanguard and FMR LLC) may also be individual shareholders who own the shares in street name.

Conclusion

These facts are for readers to use. Whether shares of OMF are a favorable investment is for them to decide.

Like this post? See the main page for the rest of the Financial Freedom series!