Like this post? See the main page for the rest of the Financial Freedom series!

Hanesbrands, Inc. is a leading producer of socks, underwear, and related apparel in the United States. Its leading brand, Hanes, is America’s largest seller of apparel, with its products found in 9 out of 10 households.

History

Origins (1900 - 2006)

The main brand, Hanes, famous for its Michael Jordan commercials, was originally founded in 1900 in Winston-Salem, North Carolina. In 1979, Hanes was acquired by Sara Lee (ticker SLE), which later spun it off into the current company, Hanesbrands, in 2006.

Acquisitions (2006 - 2019)

Hanesbrands, as its name implies, includes multiple brands besides its the iconic Hanes. In addition this brand, the spinoff from Sara Lee ultimately included other recognizable brands, such as Champion, Bali, Playtex, and L’eggs.

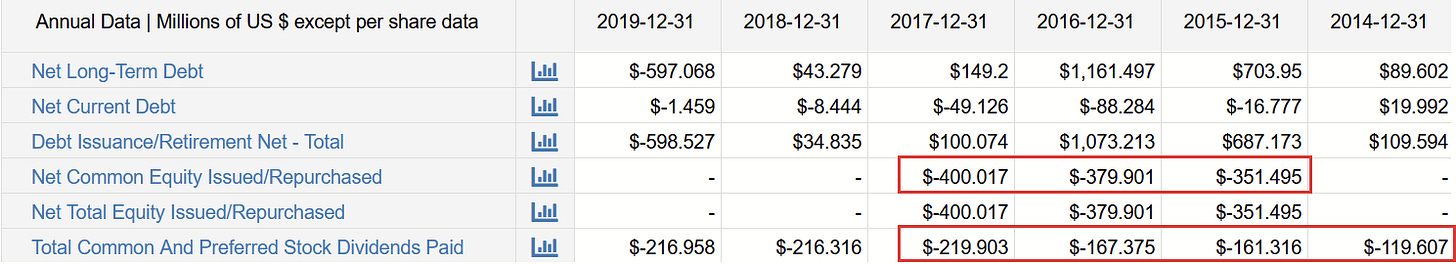

The 2010s were marked by acquisitions, concurrent with significant debt, share repurchases, and dividend payments. Between 2013 and 2018, the company about tripled its long-term debt, to pursue several acquisitions, most of which were international versions of their American brands. Their long-term debt grew from about $1.5 billion in 2013, to over $4 billion by 2018.

Yet, tripling their debt did not triple their cash generation. From 2013 to 2019, cash flows from operating activities rose from about $590 million to an all-time high of $803 million by 2019.

This coincided with over $1 billion in share repurchases and an increase in annual dividend payments to shareholders by almost $100 million per year. The long-term debt never declined lower than $3.5 billion. Much of this debt was collateralized by the assets of the almost the entire company, something that has been consistently mentioned in the company’s annual report under its risk factors.

These share repurchases also occurred while HBI traded at its highest levels in history, not at a discount.

2019 saw the departure of a permanent Chief Financial Officer, a position it did not refill until July 2023.

COVID, Supply Chain Disruptions, Inflation (2020 - Present)

The arrival of COVID in 2020 saw the beginning of complications. The recession triggered by the pandemic reduced their revenues, but this was mitigated somewhat by their ability to refit their factories to produce medical masks that were bought and worn by millions, making up for some lost sales. Decreasing infections and lessening lockdown restrictions caused their cash flows to increase again in 2021. Nevertheless, they exited and divested from their European innerwear operations and their L’eggs brand.

The rise of inflation in 2022 (brought on by the ongoing supply-chain disruptions from COVID, quantitative easing by the Fed, and the energy crisis triggered by the Russian invasion of Ukraine) finally broke the back of their balance sheet. In particular, a spike in the price of cotton. This increased the company’s operating expenses, causing 2022 to be the first year in which they ever experienced negative cash flows from operations (about -$360 million).

With higher operating costs and declines in purchases of new socks and underwear by most of the American market (as consumers were reacting to inflation), this was too much for the company to be able to pay off its $3.5 billion of debt without some changes.

In its Q422 earnings release, management declared that they were suspending the common stock dividend entirely, freeing up about $200 million in annual cash flow, in order to pay down their debt. Since much of the debt they raised in the 2010s was due 2024, a near-term risk of default (for which there was a lien on most of HBI’s assets) was at hand. The same month they announced they were suspending their dividend, management also announced that they were refinancing $600 million of their debt due 2024 at interest rates of 3.25% and 4.625% with new notes due 2031 at a rate of 9%, causing their annual interest expense to increase tens of millions of dollars.

They also made a sudden revision of the deferred tax assets, of which hundreds of millions disappeared from the balance sheet.

Current Strategy

Hanesbrands operates a largely vertical operation. As of 2022, approximately, 60% of its apparel is manufactured in their own facilities or those of “dedicated contractors.” About 69% of sales were in the U.S., and about 16% of sales happened through Wal-Mart, their largest customer.

As America’s largest manufacturer and seller of apparel and with its recent exits or divestitures of subsidiaries, the company does not appear to be poised for growth or aiming toward such. Its primary goals, per management’s announcements in 2023, is managing its cash-flow situation and paying down its substantial debt, which it may struggle to do.

Interestingly, the plight of Hanesbrands is not unlike that of Fruit of the Loom in 2002. One analyst even spotted this in 2017. An archive of Berkshire Hathaway’s annual meeting for that year shows Warren Buffett’s elaboration on his reason for acquiring FotL, America’s other major producer of socks and underwear.

Buffett explains that the business was essentially fine, selling a staple product at low cost but that it had been mismanaged with poor financial decisions of management, who had saddled it with debt. Berkshire picked the company up in bankruptcy court, on the condition that a prior, more responsible manager return to run the company, and it’s been a profitable venture for Buffett since.

Hanesbrands is likely in a similar scenario. It has a well known product in a market to which there are high barriers to entry. With the vertical model they have and relative economy of scale they enjoy, the company’s main concern at this point is paying off its debt, improving its cash flow, and then only paying dividends or buying back shares when it makes sense to do so.

Conclusion

These facts are for readers to use. Whether shares of HBI are a favorable investment is for them to decide.

Like this post? See the main page for the rest of the Financial Freedom series!