Like this post? See the main page for the rest of the Financial Freedom series!

Cleveland-Cliffs is the largest producer of flat-rolled steel in the country and operates primarily in and around the Great Lakes and Appalachia. Their directly-owned mines and steel scrap suppliers are processed into steel products for sale to their customers.

History

Origins

The company started as the Cleveland Iron Company in 1847. As technology for refining steel improved, and as more iron deposits were found in the Great Lakes area, the industry experienced major expansion, resulting in a series of acquisitions and mergers that formed the current company, Cleveland-Cliffs, in 1890.

The Twentieth Century saw the company shift from mining hard-rock deposits to soft hematite deposits, as well as a shipping business along the Great Lakes. Cleveland-Cliffs was a major source of iron during both World Wars and with the invention of the automobile. In the latter half of the century, they began a process of installing adjacent pellet plants to their mine sites, improving their vertical operation. It also saw the shrinking of their operations, with massive layoffs, in response to recessions and its exit from Great Lakes shipping.

Globalization (2001 - 2012)

With the passage of a beneficial tariffs under President Bush, the company moved to expand globally into the broader iron market, acquiring businesses and assets in Canada, Brazil, Australia. It also expanded into coal operations in these areas. These acquisitions continued during the Great Recession, often at high prices. The company changed its name to Cliffs Natural Resources in 2007.

Return to American Iron (2013 - 2019)

The larger company proved difficult to manage effectively. Operating cash flows declined, while capital expenditures were high, sometimes exceeding cash generation.

Consequenty, CLF’s dividend was slashed signifcantly.

Joseph Carrabbas, who had served as CEO from 2005 to 2013, announced that he would retire. After an interlude, the activist hedge fund Casablanca Capital successfully won control of six directors, giving them control of the board in 2014. They then proceeded to elect Lourenco Gonclaves as Chairman, President, and CEO of the company, who has been leading it since then.

Gonclaves initiated reforms, returning to the core business of American iron, trimming the company of it recent acquisitions, and bringing back the name Cleveland-Cliffs in 2017. That same year, they announced the release of a Hot Briquette Iron (HBI) plant in Toledo, Ohio. By 2019, they had increased their operational mines in the Great Lakes from 1 to 4.

They also acquired AK Steel for $1.1 billion. This represented a major improvement in their vertical model, allowing Cleveland-Cliffs to produce flat-rolled steel with its iron supply, a major commodity for the manufacture of automobiles, and giving it a much more diverse base of customers to support its cash flows.

By 2019, the company’s balance sheet showed signs of improvement, with shareholder’s equity finally becoming positive in that year.

Operating cash flows were increasing incrementally, while capital expenditures were proving much more manageable.

Steel Renaissance (2020 - Present)

The onset of COVID presented brief stress, with 2020’s operating cash flows becoming negative for the first time in over a decade, at $-258 million. The company had to add $3 billion to its long-term debt (from $2b to $5b). Nevertheless, the improvements in the prior years meant company had a pool of cash as a buffer against this, and Cleveland-Cliffs continued to move forward.

The latter part of 2020 also witnessed their acquisition of ArcelorMittal, a major steel manufacturer, the boldest expansion of the company’s vertical model. It also finished the construction of its HBI plant in Toledo, which had cost about $800 million to develop.

2022 saw the acquisition of Ferrous Processing and Trading Company, which added scrap collection to its vertical pipeline of raw materials.

Positive cash flows returned in 2021. Since then the company has successfully reduced it long-term debt down to $3.4 billion, through prepayments or purchases of their notes in the open market at attractive discounts to par. Similarly, they have moved on decreased prices for CLF since interest rates knocked the market down in 2022. 10% of the outstanding shares have been repurchased over the last two years.

In the summer of 2023, Cleveland-Cliffs made an offer to acquire all of U.S. Steel (ticker: X) for a deal valued at $7.3 billion, but this offer was rejected.

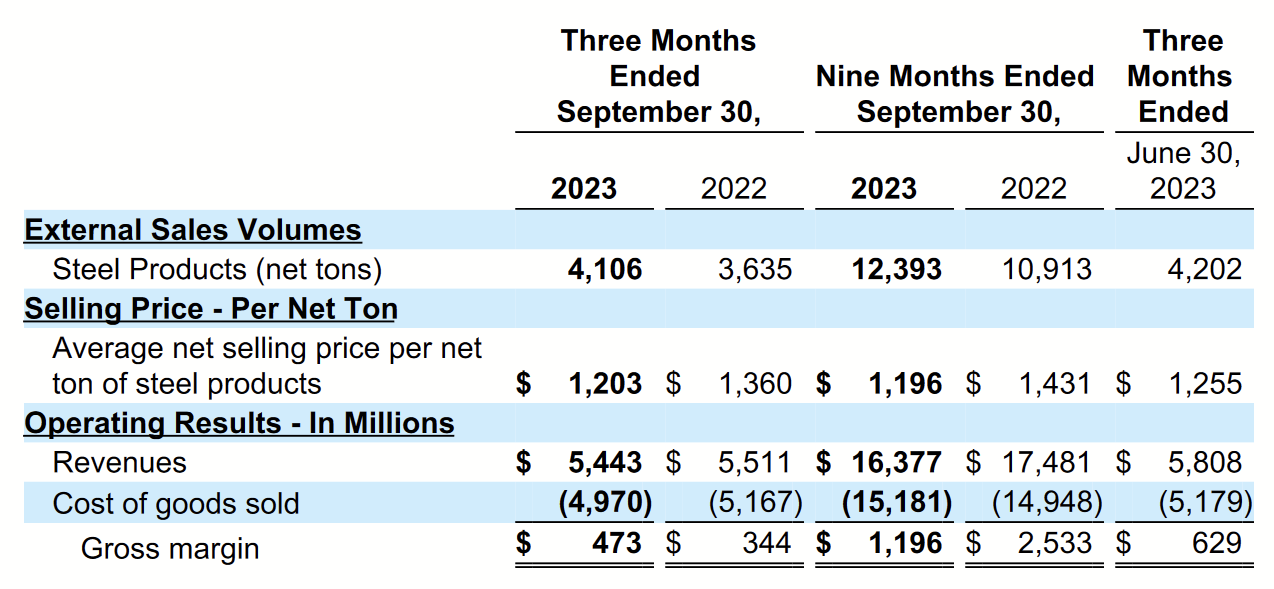

Despite the rejection, this recent period fully demonstrated Goncalves’s vision. This was directly observable from synergies realized from 2022 to 2023. While net tons of steel sold year-over-year rose about 13%, overal cost of goods sold actually declined by 3.8%.

Current Strategy

Lourenco Goncalves

The strategy would not be worth discussing without highlighting Lourenco. A businessman from Brazil, with a rich background in the industry, he successfully and radically transformed Cleveland-Cliffs from a globalist mining conglomerate that had little discipline in its capial allocation or cost management into what it is today, a highly integrated, self-sufficient, U.S.-focused ecosystem of iron and steel production.

Lourenco has stood out in the press a few times as a combative strongman of a CEO. Check out this CNBC interview from 2018.

This passion is backed by results. Crucially, his focus on optimizing in America proved crucial when the war in Ukraine broke out. He assumed his roles as Chairman, President, and CEO in 2014, the same year that Russia illegally annexed Crimea. With a significant amount of America’s iron supply coming directly from Ukraine and Russia, Lourenco realized that depending on them posed great risk. When the current war broke out, Cleveland-Cliffs stood alone with its personal iron supply and was able to continue selling steel products at attractive, fixed-price contracts for 2022 and 2023.

Outside of operational improvement, Lourenco deploys the company’s capital like a true investor. He has made multiple acquisitions that have added to cash generation without incurring much cost. He has repuchased shares of CLF at a discount and issued new shares when prices trend higher. He has made use of low-interest debt and similarly repaid it diligently. It’s as if there are no missed opportunities under his leadership.

Union Labor Force

As of 2022, about 90% of Cleveland-Cliffs hourly employees are represented by a union. The company has embraced unions as partners and fellow stakeholders. The three primary unions are the United Steel Workers (USW), the United Auto Workers (UAW), and the International Association of Machinists and Aerospace Workers (IAM).

With this relationship, human capital and talent is being reliably retained for the long-term, and the incentives of workers are aligned with shareholders of CLF.

Diversified Steel Products

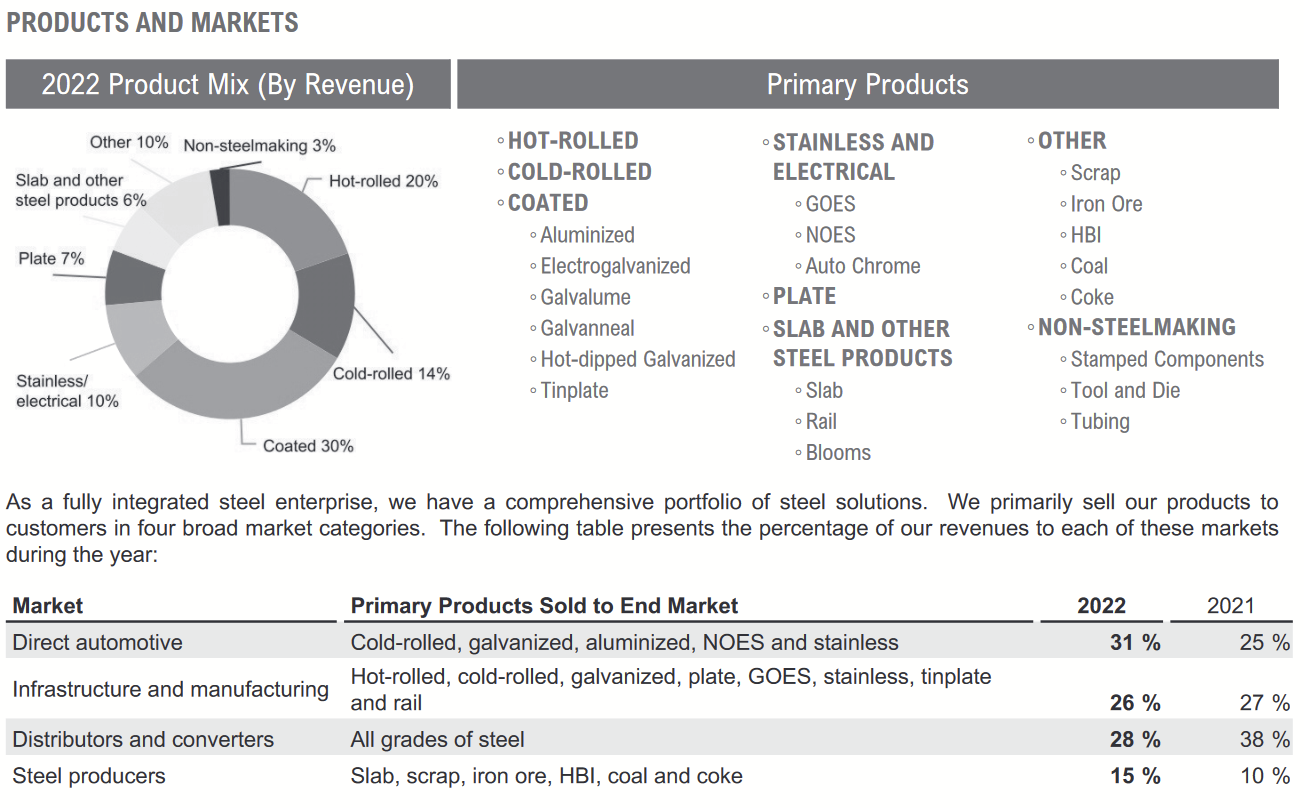

Moving into steel allowed Cleveland-Cliffs to enjoy a wider variety of customers, and they have developed their operations to adjust to fluctuations in demand. Most of their sales are of flat-rolled steel for manufacture of automobiles.

This mix makes them well positioned to respond to changes in demand for steel, as well as specific uses. As the automobile industry returns from the lull of its current cycle, and as demand for electric vehicles increases, Cleveland-Cliffs will be there to capture those opportunities.

Cash Flow

Recent years have shown that the company enjoys about $2.5 billion in cash generation before capex, with $1.5 billion afterward. These data are new, fresh after many acquisitions. With these growing synergies continuing to reduce operating costs and room for heightened demand in the near future, Cleveland-Cliffs will have ample opportunities to acquire more businesses, export to foreign markets, repurchase shares, or even pay ambitious dividends.

Risks

Loss of Lourenco

Given the central role of Lourenco, his absence could represent a reversal of the company’s fortunes. The good news is that his son, Celso Goncalves, serves on the management team as Exeutive Vice President and Chief Financial Officer.

In his 30s and well connected to his father’s decisions and strategies at present, he and other leadership are being well groomed for an eventual transition. Nevertheless, family hand-offs have sometimes been fumbled, and long-term investors should monitor the potential of Celso closely.

Free Trade and Politics

In the Q323 earning call, Lourenco indicated that he wants more free trade, so that Cleveland-Cliffs can export to friendly nations like the UK. Nevertheless, protectionist policies have been very helpful to the company, where iron miners and steel manufacturers in the world compete with cheaper labor. A change in political tides, against American industry and labor, could expose them to new competition internationally. That said, their domestic model has also shielded them from instability in other regions.

Like this post? See the main page for the rest of the Financial Freedom series!